irs tax act stimulus checks

You can check the status of your payment with the IRS Get My Payment tool. We use chase for our bank.

How To Get Your Second Stimulus Payment Direct Deposited To Your Bank Account

No the payment is not income and taxpayers will not owe tax on it.

. If correct check the box. The second round of stimulus payments are based on the information reported on your 2019 tax return. Technically they served as an advanced tax credit on your 2020 income taxes.

Eligible people can claim Recovery Rebate Credit. How to Claim a Missing Payment. Is my stimulus payment taxable.

Non-filers have until October 15 to claim their payments The IRS. Out of those 159 million payments 120 were sent via direct deposit 35 million by check and 4 million by pre-paid debit cards. The Consolidated Appropriations Act 2021 added additional funds to this credit which basically serves as a second stimulus payment for most taxpayers.

We mailed these notices to the address we have on file. I used Tax Slayer and am having the same problem. In the somewhat longer words of the IRS.

The IRS has stated that 159 million stimulus checks have been processed in the past two months totaling almost 267 billion. Stimulus Check Payment One. I called the IRS when I found out I shouldve received my stimulus payment by.

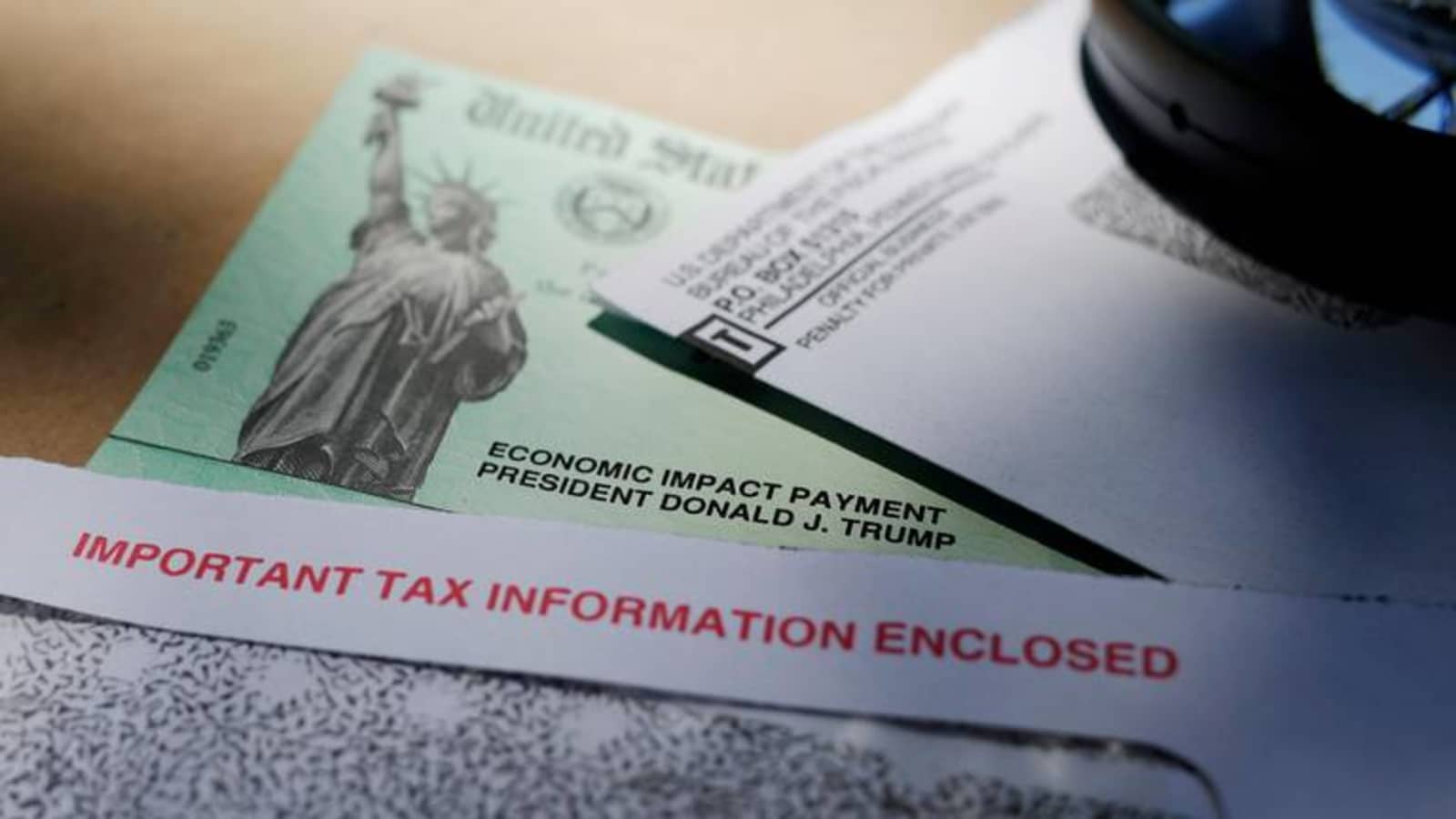

To find the amount of your Economic Impact Payments check. 600 in December 2020January 2021. The IRS issued three Economic Impact Payments during the coronavirus pandemic for people who were eligible.

It is one of a multitude of. TaxActs free Stimulus Registration service has been designed to help millions of Americans submit their information to the IRS in order to receive their stimulus payment also known as the Economic Impact Payment. Claim Stimulus 3 by filing or e-filing a 2021 Return.

The tool does not allow taxpayers to update their direct deposit info its only purpose is to show the status of. The IRS will issue the stimulus payments through direct deposits and mailed checks. What to know if you worked from home received stimulus checks became victim of unemployment.

It will show you both how and when you will receive your stimulus payment. For those of you who had your income change in 2020 you could be owed stimulus money. The IRS deposited my Economic Stimulus Payment into an account at the Bank of Republic because I paid Tax Act for the filing of this return with my return.

Since both stimulus payments were sent out before the 2020 tax return was filed the IRS used the information they had on file for individuals from their 2019 tax returns to determine the amount of money each qualifying person should receive. IR-2021-44 Tax Time Guide. If you do NOT check the box no bank account information will be sent and you will receive your stimulus payment as a check from the IRS.

The Recovery Rebate Credit was added for 2020 as part of the CARES Act to reconcile your Economic Impact stimulus payment on your 2020 tax return. IR-2021-36 Get ready for tax season using IRS Online Account. COVID-19 Stimulus Checks for Individuals.

Transcript says 14 and the check my payment or whatever its called shows status not available. Im so confused on whats going on and our stimulus is no where to be found. You may be eligible to claim a Recovery Rebate Credit on your 2020 or 2021 federal tax return if you didnt get an Economic Impact Payment or got less than the full amount.

The important details you want to know. Currently the second stimulus payout is as follows for those eligible. These payments were sent by direct deposit to a bank account or by mail as a paper check or a debit card.

As a result of the Coronavirus Pandemic the US government has launched three stimulus check payments during 2020 and 2021. On the screen titled Verify that your bank account information is correct double check your bank account information entries. Check eligibility for Recovery Rebate Credit.

The Economic Impact Payment EIP CARES Act or Stimulus Check Payment One was launched in April of 2020. En español The Internal Revenue Service IRS is sending out millions of checks in the third round of stimulus payments. 1200 in April 2020.

According to a press release issued by the Internal Revenue Service last week almost nine million eligible Americans who arent required to file an income tax return have yet to receive their stimulus checkThe IRS are busy contacting those who havent been issued a payment encouraging them to apply for one before it is too late. Recipients received them by either direct deposit to bank accounts or debit cards or through a mailed check. 1400 in March 2021.

As people start to spend their money some wonder. Securely access your IRS online account to view the total amount of your first second and third Economic Impact Payment amounts under the Tax Records page. How to do taxes for free and get refunds fast.

We filed with Tax Act and had our fees taken out of our return. The stimulus payments are an advance on a tax credit specifically designated for the 2020 tax year. IR-2021-38 As required by law all first and second Economic Impact Payments issued.

Those stimulus checks are also referred to as economic impact payments or recovery rebates. 15 2021 The state of Maryland has passed the RELIEF Act of 2021 which provides 1 billion in emergency coronavirus relief to individuals and small businesses. Delete state return if you have one.

Up to 10 cash back To prepare for the possibility of a third stimulus payment the IRS urges filers to consider filing their 2020 tax returns as soon as possible. You can no longer use the Get My Payment application to check your payment status. Below is all the information you need to know for stimulus check registration during the coronavirus crisis.

How Many Stimulus Checks Were Issued In 2020 And How Many People Received Them As Com

Us Stimulus Checks For Americans Abroad All The Details

Stimulus Check Disputes How Couples Can Resolve Them

Timing Income Tax Filing Just Right Could Mean A Bigger Stimulus Check

American Rescue Plan What Does It Mean For You And A Third Stimulus Check Turbotax Tax Tips Videos

The Irs Is Still Issuing Third Stimulus Checks We Ve Got Answers To Your Faqs Forbes Advisor

Stimulus Payments May Be Offset By Tax Debt The Washington Post

Will The Child Tax Credit Affect My 2021 Tax Return

Stimulus Checks Didn T Get Your Relief Payment Yet You Aren T Alone The Independent

Look For Line 30 On Your 1040 To Claim Your Stimulus Payment The Washington Post

How To Claim Missing Stimulus Payments On Your 2020 Tax Return

Deadline For 1 400 Plus Up Stimulus Check Payments Is Today How To Apply For Cash Before It S Too Late

Stimulus Check Scams Here Are Red Flags To Watch For

Still Didn T Get Your Stimulus Checks File A 2020 Tax Return For A Rebate Credit Even If You Don T Owe Taxes

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Where To Add Your Stimulus Money On Your Tax Return Taxact

U S Expats Coronavirus Stimulus Checks Top Faqs H R Block

Stimulus Checks Delayed But I R S Says They Re Coming The New York Times

Your Stimulus Check May Not Come Until 2021 The Washington Post